capital gains tax india

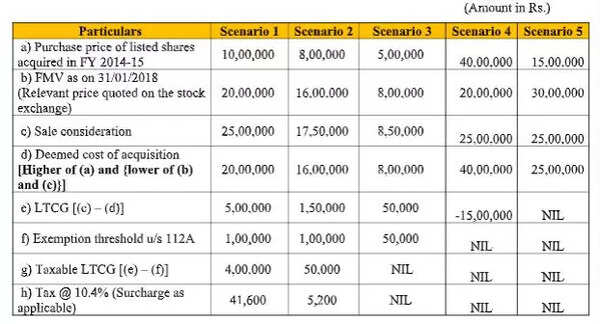

Short Term Capital Gains STCG. LTCG fee is currently only accessible for listed shares and mutual fund units.

What S New In Capital Gains Tax For 2018 19 Income Tax Refunds

Tools To Nullify or Minimise Capital Gains.

. The Capital Gains Tax CGT depends on whether the gain was made quickly or over a long period. Long Term capital gains are 10 and above on the sales. Calculation of short term capital gains.

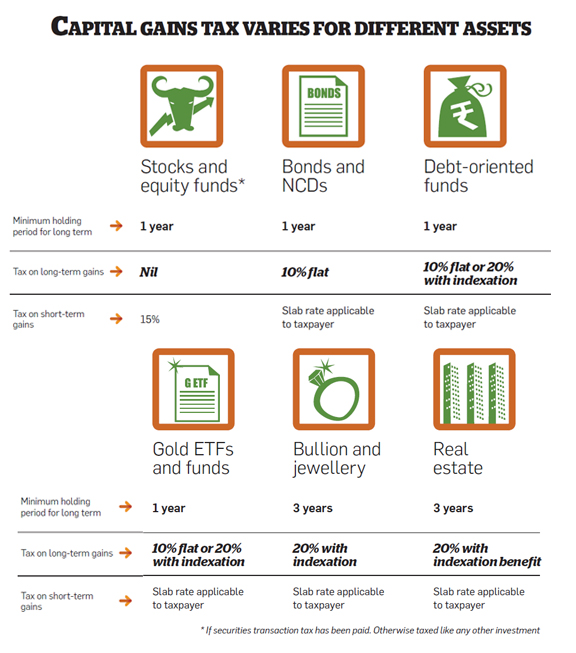

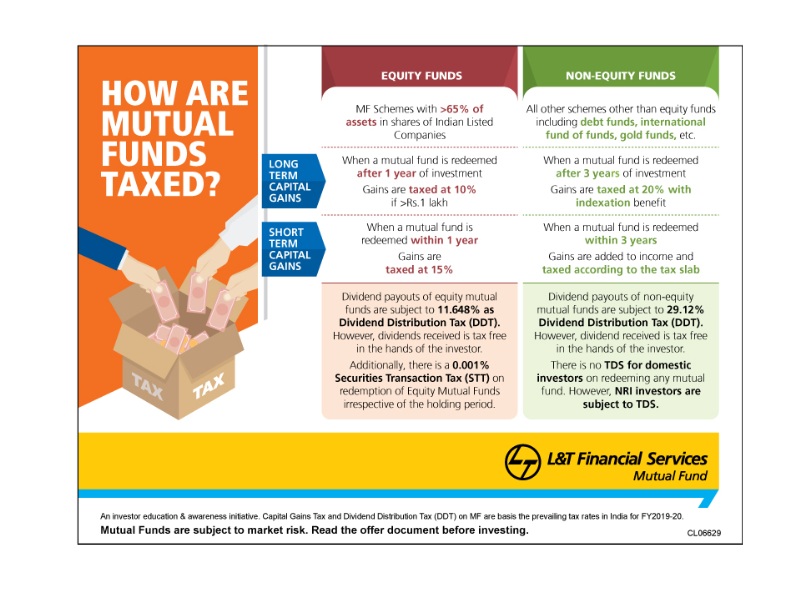

People who make short-term capital gains are taxed at 15 under Section 111A of the Income Tax Act 1961. Capital gain is any profit or gain that occurs from the sale of a capital asset. Long-term capital gains rates range from 10 to 20 depending on the type or class of assets.

The gains made on capital. Capital gains tax is calculated as per the sellersindividuals income tax slab rates Long Term Capital Gains Tax Duration of holding a property from the date of ownership is. Long-term capital gains are not taxed up to INR 100000.

Long Term capital gain tax is applicable at 20 except on the sale of equity shares and the units of equity-oriented funds. Capital gains tax in India 3 Rules you may not be aware of By Manikaran Singal Capital gain tax is a known term for all investors of Equity Debt or Real estate. This gain comes under the category income and hence you will need to pay.

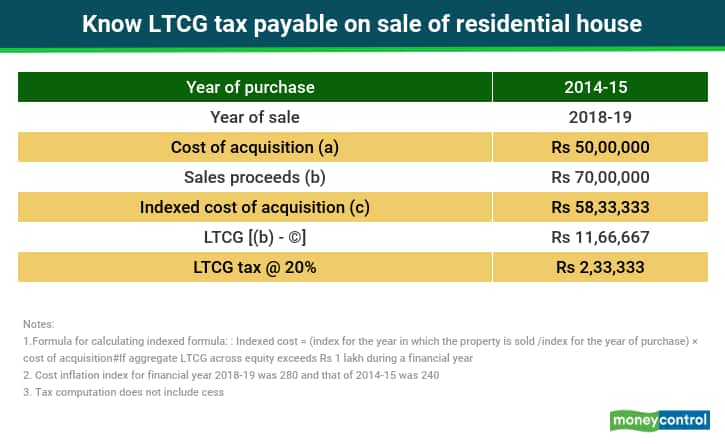

Long-Term Capital Gain Tax on Property The profit. Any profit or gain that arises from the sale of a capital asset is a capital gain. Taxpayers can claim the benefit of indexation.

Capital gains tax which is levied on profits from the sale of assets is expected to raise 15 billion in the current tax year according to the Office for Budget Responsibility. What is Capital Gains Tax in India. The following percentage of tax deduction is available under such.

To calculate the short term capital gain the formula is as follows. Taxed 20 with indexation benefit. Board of India Act 1992 will always be treated as capital asset hence such securities cannot be treated as stock-in-trade.

Currently long term capital gains are taxed at the rate of 20 plus health and education cess. Tax on short-term capital gain is calculated by subtracting sale price from the purchase price and the tax is as per the income tax slabs applicable to NRIs. The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15.

TAX ON LONG-TERM CAPITAL GAINS Introduction. The 36-month condition has. If your holding period is more than two years more than 24 months then it is called a long-term capital asset.

Tax on long-term capital gains arising to any person on transfer of securities other than units listed on a recognised stock exchange in India or a zero-coupon bond is. All property savings for exempt types some gifts the sale of inherited property the transfer of shares and assets upon divorce or the dissolution of a civil partnership and the sale. Formula to Calculate Capital Gain STCG Sale price - acquisition cost improvement cost transfer cost LTCG Sale price - cost of acquisition considering.

1 day ago Taxed as per your tax slab. Full value of consideration cost of acquisition cost of improvement expenses. On this applicable Tax amount you can get the deductions under the 80C and 80U.

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a short-term. When you sell your property 3 years. If in above case Stamp Duty Value of property is INR 60 Lac then 60 Lac shall be considered as Sale Value and capital gains would be Rs 28 Lac.

The income tax on. Various tax exemptions can. Besides this the both long.

Short Term Capital Gain Tax Rs 420000. Capital assets are investments like house land stocks mutual funds jewelry trademarks etc. When an asset is held for less than 36 months any profit on sale thereof is considered short-term capital gains.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

How To Adjust Reduce Avoid Capital Gains Tax The Economic Times

How To Save Capital Gain Tax On Sale Of Residential Property

How To Save Capital Gain Taxes In Real Estate

The Long And Short Of Capitals Gains Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Capital Gains Tax Various Types Calculation Exemptions Simplyrupee

What Are The Capital Gains Tax Rules For Different Investments In India

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Union Budget Changing Face Of Capital Gains Taxation Since 2014 Times Of India

Long Term Capital Gain Tax On Sale Of Property In India Sbnri

Investment In India What Is Capital Gains Tax In India And What The Rates Of Tax An Overview

Capital Gains Tax Types Exemption And Savings Forbes Advisor India

How Are Mutual Funds Taxed The Economic Times

Tax Rules For Nris On Sale Of Assets Located In India Mint

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

What Is Capital Gains Tax Definition Meaning Basics Of Capital Gains Tax

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India